China Needle Coke Prices Reverse Global Trend

In 2018, the overall performance of China’s needle coke market was relatively stable with prices showing an uptrend and reaching its high in the month of November. However, towards the end of 2018, the plunge in steel demand from downstream sector in China adversely impacted the country’s graphite electrode requirement and so does the needle coke demand and prices.

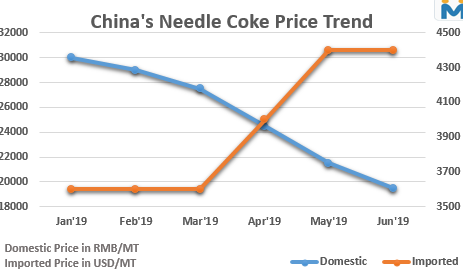

With the start of 2019, China’s domestic needle coke prices have been falling and have registered a plunge of 35% in the time span of six months. However, the price of high-quality needle coke required for UHP grade GE (usually imported) has been rising continuously recording a surge of 22% during Jan-Jun’19. The domestic needle coke prices in China are currently trending in the range of RMB 19,000-20,000 (USD 2,750 – 2,900/MT) whereas imported needle coke prices are at 4,200 – 4,600/MT.

According to customs data, in the first four months of 2019, China's petroleum-based needle coke import volume was 46,413 tonnes, 70% of which came from the United Kingdom, 15.3% from the United States, and 9.5% from Japan whereas country’s coal-based needle-coke imports were 27,819 tonnes of which 62% came from South Korea and 38% from Japan.

Although the domestic needle coke produced in China still has some time to match the global standards, with the help of some research and development, the quality of the same has improved to some extent and few products have been able to mark their entry in the international market also.

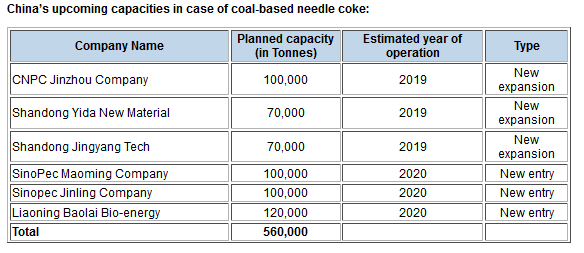

At present, the production capacity of domestic needle coke in China is in the period of rapid expansion and in 2019 some new projects will be officially put into operations.

Column: EU’s pledge for $250 billion of US energy imports is delusional

Anglo American posts $1.9B loss, cuts dividend

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Southern Copper expects turmoil from US-China trade war to hit copper

Trump tariff surprise triggers implosion of massive copper trade

Eldorado to kick off $1B Skouries mine production in early 2026

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Newmont nets $100M payment related Akyem mine sale

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge

Gold price rebounds nearly 2% on US payrolls data

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge