India: Low Grade Iron Ore Fines Export Prices Remain Stable

As per the participants, miners and traders are also selling high-grade iron ore fines to China (between 60-62% grade).

Why low-grade iron ore exports have continued to remain high?

1. Expectation of stiff iron ore supply in the market-: Seaborne iron ore prices strengthened on increased buying interest from traders amid expectations of continued tightness in the supply side. As the Vale, BHP, Rio Tinto, and others were forecasted iron ore production at the lower end last month.

2. Global iron ore (Fe 62%) continuously trading at high-price -: Spot iron ore prices increased amid shortage of global supply Fe 62% fines price increased to USD 96/MT, CFR China last week and still fines are still trading high at USD 95/MT, CFR, China. The month of April is marked by highest construction activities in China and also relaxation in production curbs in the country has led to increased preference for lower grade ore in China.

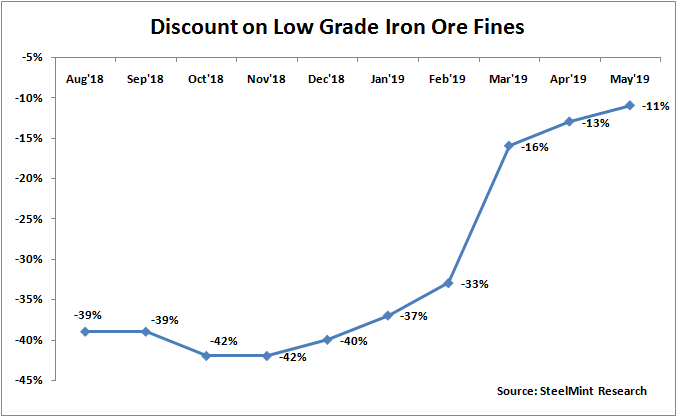

3. Narrowing discounts of low-grade ore –: Fortescue Metals Group - world's 4th largest iron ore producer has reduced iron ore discount for SSF (super special fines) to 11% in May’19 from 13% in Apr'19. Discount from the miner has dropped sharply from as high as 42% in Oct-Nov'18 to 33% in Feb'19, 16% in Mar'19,13% in Apr'19 and 11% in May'19.

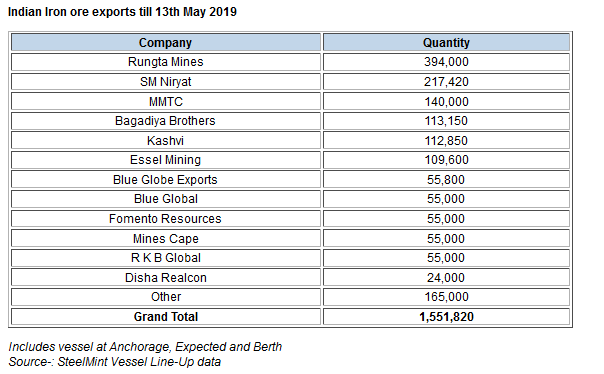

Indian iron ore exports expected to cross 1.5 MnT in May’19 -: As per the vessel line up data maintained with SteelMint till 13th May’19, vessels carrying for around 1,551,820 MT iron ore lined for exports. Out of this 1,219,170 MT from Eastern port of India and rest 332,650 MT from other ports. So far in this month, Rungta mines export volumes are expected to remain around 0.4 MnT followed by SM Niryat at 0.22 MnT.

Indian Iron Ore Exports Hit-1-Year High in Apr'19-: Indian iron ore export volumes increased by 14% to 1.36 MnT as against 1.19 MnT in Mar’19. On yearly basis, iron ore export increased by 15% as against 1.18 MnT in the month of April’18 last year. Iron ore exports from India have climbed to 1-year high as similar level of exports was last seen in Mar’18 at 2.63 MnT.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook