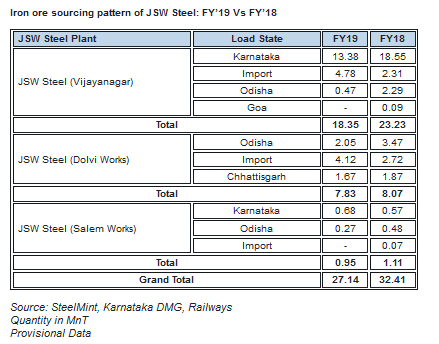

India: JSW Steel Iron Ore Sourcing: FY19 vs FY18

The company raised imports sharply and remained the largest importer in FY'19 and import volumes were recorded at 8.90 MnT, up 74% as against 5.10 MnT in FY’18. The steelmaker imported majority of iron ore from Australia at 7.03 MnT in FY’19 and rest from Brazil.

The company received high discount from Australia for low-grade iron ore. Domestic iron ore prices from Odisha traded very high during Sept-Nov 2018 influenced by the hike in pellet exports demand from Chinese steel mills. Also temporary suspension in few major Odisha mines resulted in increased Indian iron ore import volumes.

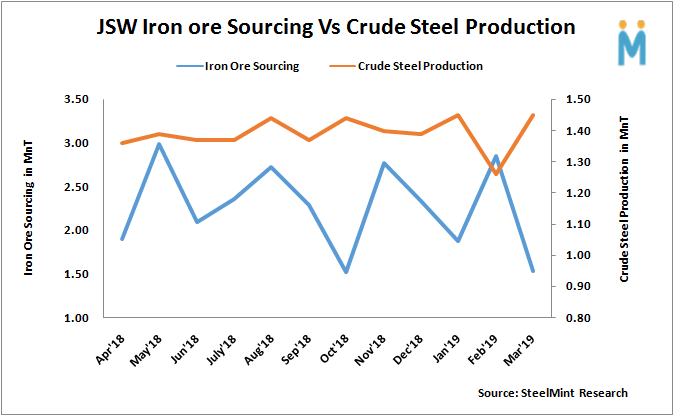

On monthly basis, sourcing dropped 46% in Mar’19 to 1.53 MnT as against 2.85 MnT in Feb’19.

Sourcing from Odisha down sharply in FY19

The steelmaker procured 2.79 MnT iron ore from Odisha based miners in FY19, down 55% compared to FY’18 sourcing at 6.23 MnT. High domestic prices led to fall in procurement from Odisha miners in FY’19.

Sourcing from NMDC (C.G.) down by 11% in FY’19

JSW Steel sourcing down by 11% from NMDC C.G to 1.67 MnT in FY’19 as against 1.87 MnT in last fiscal year.

JSW iron ore purchases from Karnataka e-auction fell 26% in FY’19

JSW Steel’s iron ore purchases from Karnataka e-auctions dropped by 26% to 14.07 MnT in FY'19 compared to 19.11 MnT in FY18.

JSW Steel’s iron ore purchases from Karnataka e-auctions decreased by 48% to 1.02 MnT in Mar'19 compared to 1.98 MnT in Feb'19. Out of 1.02 MnT iron ore sourced by JSW, NMDC supplied 0.36 MnT down by 66% against 1.04 MnT last month and thus contributed around 35% of total sourcing. JSW Steel’s iron ore sourcing from private mines also decreased by 29% to 0.66 MnT in Mar’19 as against 0.93 MnT in Feb’19.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook