Global Iron Ore & Pellet Import Market Scenario in 2018

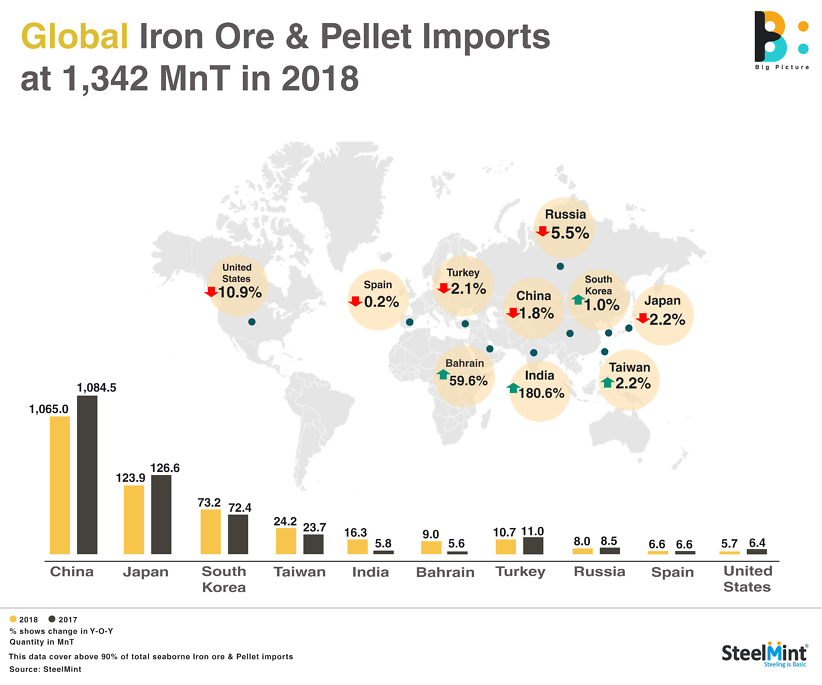

China: According to General Administration of Customs, China - the world's largest iron ore consumer and importer recorded iron ore and pellet imports at 1,064.3 MnT in CY18. The imports have dropped marginally by 2% as against CY17 imports at 1,084.5 MnT. The fall is first annual drop since 2010. The drop is owing to reduced restocking demand due to narrowing steel margins in last quarter of the year. The steel mills are further expected to reduce consumption of medium and high grade ore in 2019.

Japan: Japan, the second largest iron ore importer of the world, recorded iron ore imports at 123.87 MnT in CY'18, down 3% as against CY17 imports at 126.6 MnT. Japan's crude steel output recorded marginal decline on yearly basis to 104.3 MnT in CY18 as against 104.7 MnT in CY17. Australia marked the largest iron ore exporter to Japan at 72.14 MnT followed by Brazil at 33.28 MnT and Canada at 6.09 MnT.

Indian exports to Japan dropped 36% to 1.85 MnT in CY18, against 2.88 MnT in CY17. This is due to expiry of NMDC’s LTA to export iron ore to Japan. This led to nil exports by miner from Apr’18 to Aug’18. On 25th April'18, NMDC received approval for supply of iron ore to Japan and South Korea. However, the miner resumed exports in Sep'18.

South Korea: World's 3rd largest iron ore importer - South Korea has witnessed rise in iron ore and pellet import volumes in CY18. The imports witnessed at 73.16 MnT, up marginally as against 72.43 MnT in CY17. In CY'18, South Korean imports from Australia recorded at 51.9 MnT, up slightly against 51.03 MnT in CY17. Brazil stood second largest exporter at 10.57 MnT (down 3% Y-o-Y) followed by South Africa at 4.76 MnT (up 2% on yearly basis). South Korea's iron ore and pellet imports from India witnessed rise of 13% to 1.12 MnT as against 0.99 MnT in CY17. Indian pellet manufacturer in the CY’18 looked non-Chinese market for exports.

India: Indian iron ore import in CY18 surged in CY18 16.3 MnT, according to the customs data maintained by SteelMint. The imports have increased significantly on yearly basis as against in CY'17 to 5.8 MnT. The rise in imports is attributed to rising steel capacity, lowered domestic availability (suspension at NMDC and Odisha mines), and high discounts offered by imports of low grade ore from Australian miners. Yearly average global iron ore fines (Fe 62%) prices dropped slightly to USD 70/MT, CFR China compared to USD 71/MT, CFR China in CY17.

Bahrain: Bahrain iron ore imports in CY'18 witnessed at 8.99 MnT, up 59% as against 5.64 MnT in CY17. In CY18, Brazilian exports to Bahrain recorded at 6.13 MnT, up 58% against 3.87 MnT in CY17.Chile stood second largest exporter at 1.17 MnT followed by Canada at 1.14 MnT. Bahrain Steel - wholly owned company of Foulath Holding, recently unveiled its plans to double its pellet production over the next 10 years. It has two pelletizing plants with total capacity of 12 MnT p.a. and it is the third largest pellet producing plant in the world.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook