How Much Iron Ore Supply Disruption is Expected in CY19 - SteelMint Analysis

The largest exporter of iron ore, Australia and Brazil suffered a setback in the first quarter CY19 owing to impact of dam collapse at Vale, Brazil and cyclone in Pilbara region, Australia. These incidents have pushed iron ore prices to hit 5 years high at USD 95.05/MT CFR China for 62% iron ore fines, as assessed yesterday (9th Apr'19).

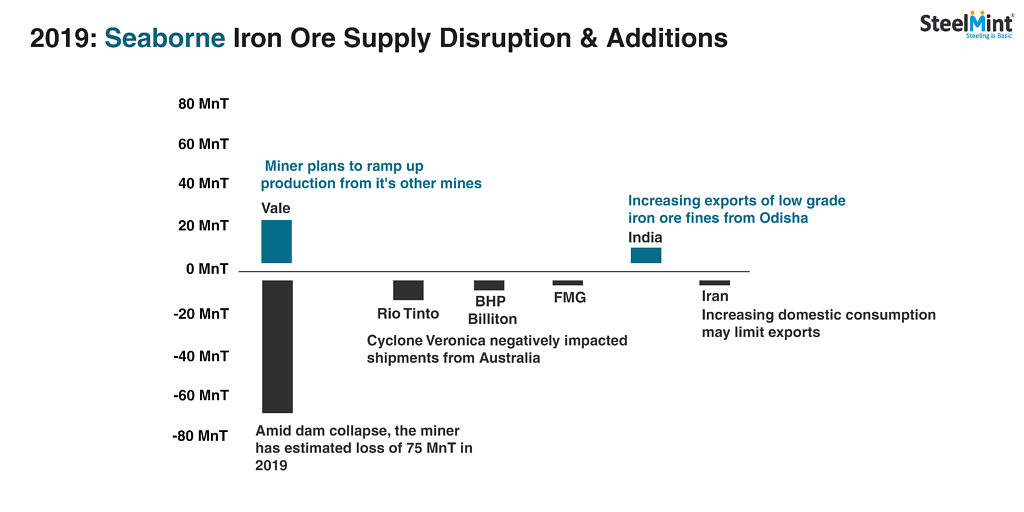

Brazilian Vale cuts iron ore sales estimates by 75 MnT

Vale underwent collapse at its dam at Corrego do Feijao mine in Minas Gerais in Brumadinho, Brazil on 25th Jan'19. Following, the collapse, operation at numerous mines and dams owned by the miner were put to halt and force majeure was declared for few contracts. On similar grounds, towards end of Mar'19, Vale reduced estimate on its iron ore sales volume for 2019 between 307 and 332 MnT. This is lower by 75 MnT against its previous estimated forecast.

However Vale might make up for around 20 MnT iron ore output from its S11 D mines, which would make the net impact to around 50 MnT deficit.

Australian miners reduced CY19 slash estimate amidst cyclone Veronica

Western Australia's Pilbara region was hit by cyclone veronica towards Mar'19 end leading to suspension of major exporting ports Port Hedland, Dampier and Cape Lambert.

• Rio Tinto had declared force majeure to some of its contracts post cyclone. Rio Tinto estimates the overall impact of cyclone is expected to result in loss of 14 MnT of production by the miner in 2019. As a result, the production is expected to be at lower end of 338-350 MnT.

• Post, the cyclone, BHP Billiton shared its production will be affected by about 6-8 MnT amidst cyclone.

• Fortescue Metals Group - world's 4th largest iron ore producer, shared disruption owing to cyclone to delay about 1.5 MnT to 2 MnT. FMG's total CY 18 shipment dropped to 167.9 MnT in CY18 against 168.8 MnT in CY17.

India iron ore exports to pick up amidst demand of low grade ore: Indian iron ore exports has picked up amidst rising exports of low grade from Odisha due to increase in prices of high grade ore. This has led Chinese mills to hunt for low grade iron ore, when steel prices have not increased in the same proportion. Fe 58/57% iron ore fines prices have increased by USD 5-10/MT in last 2 months to USD 60/MT, CFR China or equivalent to USD 50/MT FOB India.

Also, unlike last year the delay caused in resumption of NMDC's LTA to export iron ore to South Korea and Japan will also keep export volumes supported. As per SteelMint analysis, India may add around 6 MnT iron ore supply in 2019.

Iran: Iran has exported 15.31 MnT in Persian year FY'18 and depicted the fall of 26% Y-o-Y. However, amidst rising domestic demand due to expansion, the country is to limit exports for the year. Furthermore Iran plans to increase its crude steel capacity to 55 MnT p.a. by 2025, which will lead to rise in domestic demand. So as per SteelMint analysis, iron ore exports from Iran may further come down this year.

Net disruption in seaborne iron ore supply is expected to be around 75 MnT in 2019.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook