Pakistan: Domestic Scrap Prices Surge on Limited Availability

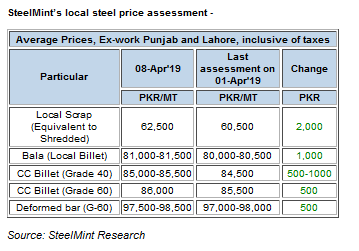

Shortage of ship plates and local scrap increases steelmakers’ dependency on imported scrap further in Pakistan. Local scrap equivalent to Shredded is being reported at PKR 62,500-63,000/MT (USD 441-445), ex-works inclusive of taxes, up sharply by PKR 2,000/MT (USD 14) on W-o-W basis.

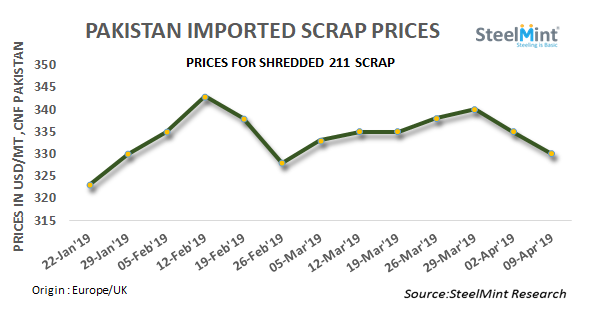

On the other side, imported scrap prices in Pakistan have been declining successively in last one weeks’ time. Major steel mills made procurement of imported scrap in significant volumes at corrected prices to replenish their stocks. However, successive softening of scrap offers from suppliers turned buyers hesitant again since last two days.

SteelMint’s assessment for containerized Shredded scrap stands at USD 328-330/MT, CFR Qasim, down USD 5/MT from USD 333-335/MT level against last week’s report. Asking rates from the recyclers in UK and Europe are being quoted at around USD 330-333/MT, CFR and USA suppliers are offering even at USD 327-330/MT, CFR Qasim. In recent trades, Shredded 211 scrap sold in containers reported sold at USD 328-330/MT, CFR Qasim.

However, offers for Middle East origin HMS 1 heard in the range of USD 325-328/MT, CFR depending on quality. Limited deals are being concluded as buyers step back with other subcontinental markets paying higher at the moment while few sellers are quoting HMS 1 in the range USD 332-335/MT, CFR.

Local steel prices inch up; no major initiative from the government yet - Local steel market is observing no significant change in the demand for steel bars due to inconsistent policies of the government. Prices marginally move up but the position remains more or less the same as last week.

Private investors remain reluctant to invest in any of the construction projects due to strict accountability from NAB. Non-releasing funds fully for Government’s metropolitan projects yet turn building contractors reluctant to take up any new projects. As a result, many contractors are not releasing overdue payments of material suppliers. Liquidity issues thus are consistently putting pressure on finish steel demand in the country.

SteelMint’s assessment of local billet prices stands at PKR 81,000-81,500/MT (USD 572-575) ex-works. Rebar prices in Northern region reported at around PKR 97,000-98,000/MT that of Southern at PKR 98,500-99,500/MT, ex-works respectively. While asking rates for steel bars G-60 being quoted at around PKR 100,000-101,000/MT, ex- Karachi inclusive of local taxes.

Gold price to hit $3,600 this year and next: CIBC

Iran’s Copper Production Continues without Interruption

Aclara Resources, Stanford University partner on AI-powered rare earth research

Ultra-rare metal rides AI boom as commodities star performer

NexMetals receives EXIM letter for potential $150M loan

SolGold to start mining copper from Cascabel in early 2028

Energy Fuels shares surge to 52-week high as it begins heavy rare earth production

Antofagasta’s copper production up 11% in strong first half

Boliden mine to host world’s deepest marathon at 1,120m

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Gold price eases after Trump downplays clash with Fed chair Powell

Three workers rescued after 60 hours trapped in Canada mine

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

KoBold signs Congo deal to boost US mineral supply

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Gold price eases after Trump downplays clash with Fed chair Powell

Three workers rescued after 60 hours trapped in Canada mine

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

KoBold signs Congo deal to boost US mineral supply

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto