Global Flat Steel Market Overview - Week 15, 2019

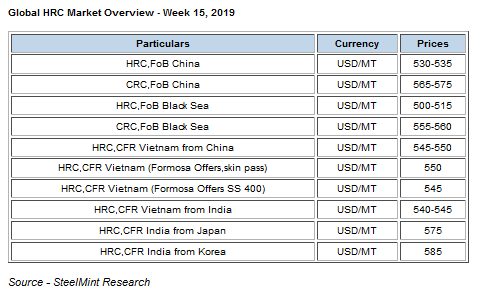

Currently nation’s HRC export offers is assessed at around USD 535/MT FoB basis. Last week the prices stood at USD 525-530/MT FoB basis.

Meanwhile prices in domestic market surge by RMB 60-70/MT D-o-D basis.Domestic prices in eastern China (Shanghai) stood at RMB 3,950-3,970/MT. Meanwhile prices at Northern China stood at RMB 3,900-3,910/MT D-o-D basis in Northern China (Tangshan).

CIS-origin HRC export offers steady amid soften market sentiments- This week CIS nation’s HRC export offers remain stable amid bearish market sentiments and sluggish buying prevailing among end users in CIS nations.

Currently offers are in the range USD 500-515/MT FoB Black Sea. Last week CIS nation's HRC export offers remained at similar levels.

Indian HRC export offers to Vietnam remain stable - Market sources shared that Indian HRC export offers to Vietnam remain stable at USD 540-545/MT CFR basis for May shipments.

Since end users in Vietnam are hesitant to make fresh bookings and are bidding offers on lower side.Thus no major deals have been concluded yet.

Last week the offers was in range of USD 545-550/MT CFR Vietnam

Imported HRC offers to Vietnam inch up from China- Imported HRC offers to Vietnam inch up this week by USD 5/MT amid uptick in HRC export offers from China.

Currently imported HRC export offers to Vietnam is around USD 545-550/MT CFR basis from China.

However dull demand and weak buying interest continue to persist amid Vietnamese buyers.

Japanese and Korean HRC offers for May shipments - Japanese based major steel mills are offering HRC export offers to India at around USD 575-585/MT CFR India.

Thus the gap between the offers and the bids is too high.However no major bookings have been concluded yet for may shipments.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook