Indian Iron Ore Exporters Increase Bookings Following Global Price Hike

As per reports received, an Odisha based major merchant miner has booked around 50,000 MT low-grade iron ore fines for export to China at USD 50/MT, FoB India for April shipment. Traders in Odisha are also learned to have booked decent quantities in recent past at the same price.

Global prices surge as miners cut sales estimates - Fe 62% fines index hit USD 92.9/MT, CFR China mark on 4th April’19. Positive outlook conducive for Indian iron ore exporters post Vale and cyclone Veronica hit at Australian ports. World's largest iron ore miners- released their output estimates for the year amidst the disruptions. Last week, Vale reduced estimate on its iron ore sales volume for 2019 between 307 and 332 MnT. This is lower by 75 MnT against its previous estimated forecast.

BHP Billiton announced its production will be affected by about 6-8 MnT amidst cyclone. Rio Tinto had declared force majeure to some of its contracts post-cyclone. Rio Tinto estimates the overall impact of cyclone is expected to result in loss of 14 MnT of production by the miner in 2019. As a result, the production is expected to be at lower end of 338-350 MnT.

Amid shrinking steel margins, Chinese mills are preferring low-grade iron ore and concentrate rather than going for high-grade ore & pellets. Following this, discounts on low-grade iron ore fines have come down to 13% which was around 16% a month back.

It is to be noted that export duty on low-grade ore is nil, making it more attractive for exports.

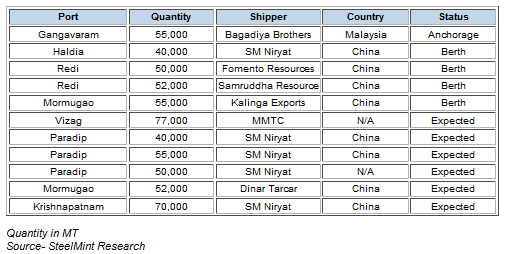

596,000 MT iron ore lined up for export at Indian ports - According to vessel line up data maintained with SteelMint and updated till 05 Apr’19, vessels carrying 596,000 MT iron ore is expected to be exported in April, out of which 387,000 MT is from eastern India ports.

Indian Iron ore exports increased sharply almost four times in Mar’19-: In the month of Mar’19, the exports increased significantly to 1.19 MnT as compared to 0.33 MnT in Feb’19 amid increased demand for low-grade ore from China on shrinking steel margins.

Column: EU’s pledge for $250 billion of US energy imports is delusional

Anglo American posts $1.9B loss, cuts dividend

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Southern Copper expects turmoil from US-China trade war to hit copper

Trump tariff surprise triggers implosion of massive copper trade

Eldorado to kick off $1B Skouries mine production in early 2026

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Newmont nets $100M payment related Akyem mine sale

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge

Gold price rebounds nearly 2% on US payrolls data

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge