Indian Iron Ore Movement Up 22% in Feb'19

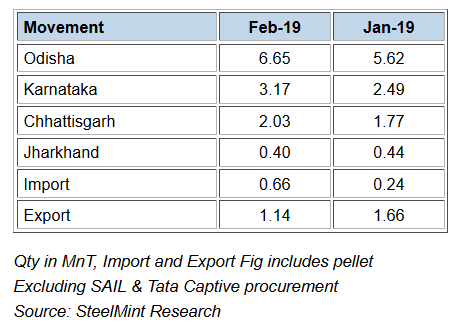

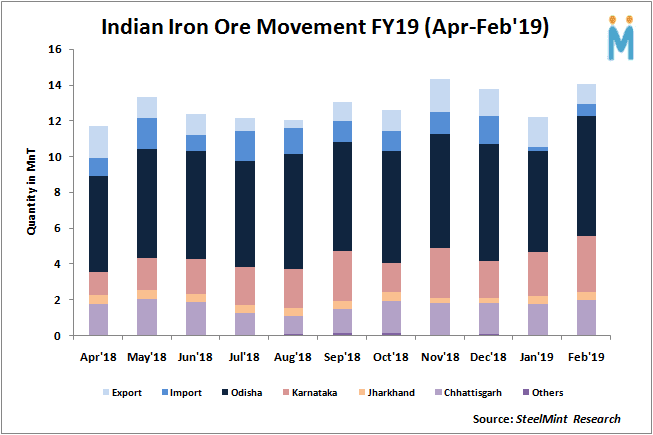

The iron ore movement has recorded 22% rise against 10.56 MnT in Jan'19. The figures are compiled on the basis of movements made via railways, trucks, and Karnataka and import data as per customs. The figures exclude the captive iron ore movement of SAIL & Tata Steel and movement for exports.

State-wise iron ore movement analysis:

Odisha Iron ore dispatches up 18% on monthly basis

Iron ore dispatches from Odisha recorded at 6.65 MnT in Feb'19, up 18% as against 5.62 MnT in Jan'19. On yearly basis, Odisha dispatches increased 31% against 5.08 MnT in Feb'18.

According to sources report, miners increased discount on bulk fines purchase. Many merchant miners in Odisha have mostly utilized their EC limits for the year and are not seen actively offering material in the market. Earlier, Odisha merchant miners had twice raised iron ore prices in the month of Feb'19 following vale incident. However, Essel mining reduced offers for iron ore lumps by INR 300/MT (USD 4/MT) and INR 150/MT in fines (USD 2/MT) towards the end of Mar'19. Earlier, on 28th Feb 2019 Essel Mining, reduce its offers for iron ore lumps by INR 400/MT.

Rungta Mines recorded highest dispatch in Feb'19 at 1.30 MnT, down 7% as against 1.40 MnT in last month, followed by Serajuddin at 0.87 MnT (up 44% M-o-M) and OMC at 0.78 MnT (up 51% M-o-M).

Iron ore dispatches from C.G up 9% in Feb'19

India's largest iron ore miner, NMDC supplied 386 rakes (1.49 MnT), up 9% on monthly basis in Feb'19, against 354 rakes (1.36 MnT) in Jan'19. The increase is attributed to price drop by miner made towards the beginning of Feb'19, post which steel and DRI producers of India made aggressive bookings from NMDC (Chhattisgarh).

Karnataka iron ore E-auction sales increased 27% in Feb'19

Karnataka has registered an increase of 27% M-o-M iron ore sales volume in Feb'19 e-auctions. Total iron ore allotted quantity stood at 3.17 MnT in Feb'19 compared to 2.49 MnT in Jan'19.

NMDC's iron ore sales increased by 27% M-o-M to 1.34 MnT in Feb'19 compared to 1.05 MnT in Jan'19. NMDC operations at Donimalai in Karnataka is still on hold. Earlier, NMDC has approached the Karnataka High Court for an urgent hearing on NMDC Donimalai lease renewal. In latest development, the High Court heard the final remarks from both the parties and the reserved case for judgement till next hearing. for which date has not been announced yet.

Indian iron ore imports fell in Feb'19

In Feb'19 iron ore imports to India was recorded at 659,774 MT according to the customs data maintained by SteelMint. The imports have witnessed increase on monthly basis as against 242,384 MT in Jan'19. Imports have picked up amidst resumption at Krishnapatnam port, which had declared Force Majeure for vessels having Draft above 14.50 MnT since 15 Dec'18.

Indian iron ore exports volume halve in Feb'19

Indian iron ore exports in Feb'19 recorded at 0.33 MnT. The exports dropped 49% as against 0.64 MnT in Jan'19. On yearly basis, the exports dropped by 84% as against 2.06 MnT in Feb'18. The drop is attributed to lesser working days in China in Feb'19 due to week long New Year holiday.

SteelMint in conversation with market participants learned that few Odisha based exporters have turned active for iron ore exports amid hike in global iron ore prices post Vale disruption. Rungta mines and SM Niryat increased export for the month of Feb'19 by 17% and 12% respectively.

Indian pellet exports down amid weak Chinese demand

Indian pellet exports have marked the drop of 20% to 0.81 MnT in Feb'19 as against 1.02 MnT in Jan'19. The exports suffered a setback due to Chinese mills preference for low grade iron ore and dull market sentiments due week long lunar New Year holiday in Feb.

China iron ore imports of Indian pellet in Feb'19 recorded at 0.66 MnT, down by 6% as against 0.70 MnT in Jan'19. South Korea stood the second largest importer at 0.15 MnT up almost three-times as compared to 0.06 MnT in Jan'19.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook