United States Steel Export Statistics 2018

US crude steel output has increased by 6% at 86.69 MnT in CY’18 up by 6.22% against 81.61 MnT in CY’17.

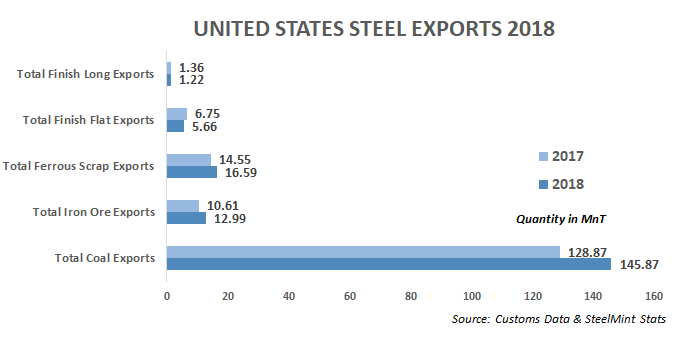

US observed a second successive rise in total Coal exports in 2018 - US coal exports continued its rising trend by posting a 13% growth in CY18. As per the data provided by US customs, the country has exported 145.87 MnT in CY18 as against 128.87 MnT in CY17.

US coal producers benefited from strong international markets. US non-coking coal typically trades at a discount to global benchmarks because of higher sulfur content, while US metallurgical coal is particularly valued for its coking properties.

In addition, coal exports were also boosted by the retirement of aging power plants in the country. With domestic demand in decline, US producers were becoming increasingly reliant on the export market. While a partial pet coke ban in India means that the buyers were compelled to switch towards US non-coking coal.

US observed a third successive rise in total ferrous scrap exports in 2018 - As per customs data, United States ferrous scrap exports recorded at 16.59 MnT in CY18, up 14% as against 14.55 MnT in CY17. The country observed a third successive rise in ferrous scrap exports against 12.25 MnT in 2015. As per data maintained with SteelMint, USA ferrous scrap exports hit last 5 years high in CY18 on boosted demand from Asian importers despite high average global scrap prices against 2017.

On yearly premises, the largest importer Turkey witnessed a marginal drop in imports from the USA occupying a total 21% share. Turkey imported 3.43 MnT (down 6% Y-o-Y) followed by Taiwan (1.88 MnT, up 42% Y-o-Y), Mexico (1.79 MnT, up 9%) and Canada (1.03 MnT, up 30%).

Growing scrap demand from Asian markets - Vietnam recorded highest ever imports from US crossing 1 MnT mark in 2018. Vietnam imported 1 MnT, up 41% Y-o-Y followed by India (0.87 MnT, up 30%), Bangladesh (0.85 MnT, up 37%) and South Korea (0.81 MnT, up 53%) in CY18.

US ferrous scrap exports dropped 12% in Dec’18 to 1.25 MnT as compared to 1.41 MnT in Nov’18.

US observed a third successive rise in total Iron Ore exports in 2018 - United States Iron ore exports recorded at 12.99 MnT in CY18, up 22% as against 10.61 MnT in CY17. The country observed a third successive rise in total Iron ore exports against 8.03 MnT in 2015.

On yearly premises, the largest importer Canada witnessed a sharp rise in imports from the USA occupying a total 78% share. Canada imported 10.07 MnT (up 30%) followed by Japan at 2.16 MnT (down 7%) and Mexico at 0.59 MnT (up 146%).

US Iron ore exports increased by 7% in Dec’18 to 1.02 MnT as compared to 0.95 MnT in Nov’18.

US flat steel exports declined 16% in CY18- United states flat steel exports registered a significant fall by 16% in CY’18 to 5.66 MnT in comparison to 6.75 MnT in CY17. Ramping up crude steel production and strong demand in the domestic market leads to falling in USA export volumes in CY18.

Major USA flat steel importing nation’s include Canada at 2.61 MnT, Mexico at 2.45 MnT, China at 0.06 MnT, India at 0.05 MnT and Malta at 0.04 MnT in CY18. Followed by Pakistan, Colombia, Italy, South Korea imported flat steel from the USA in smaller quantities in CY18.

US flat steel exports fell by 14% to 0.36 MnT in Dec’18 against 0.42 MnT in Nov'18 and plunged by 27% Y-o-Y in Dec’18 in comparison to 0.49 MnT in Dec'17.

US long steel exports declined 10% in CY18- United states finish long steel exports registered a decline by 10% in CY’18 to 1.22 MnT in comparison to 1.36 MnT in CY17. Major long steel importers from US were Canada (0.86 MnT, down 13%) and Mexico (0.26 MnT, down 10%) in CY18.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook