Indian Domestic HRC Trades Slow down; Automobile Sales Disappoint

Thus due to limited trade activities and tedious buying,traders have only increased HRC prices by INR 500/MT this week in major markets and by around INR 1000/MT in southern India.

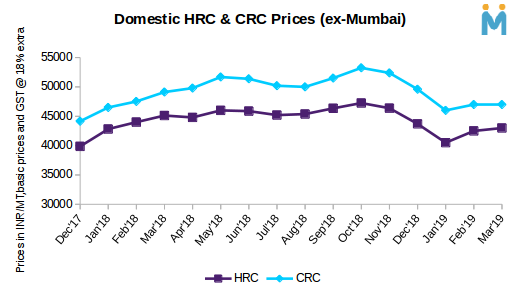

Current trade reference prices in traders market for HRC (IS2062) 2.5 mm-8 mm is around INR 42,500-43,000/MT (ex-Mumbai) and INR 43,000/MT (ex-Delhi)and INR 44,500-45,000/MT (ex-Chennai).The prices mentioned above are basic prices excluding GST @ 18% on cash payment basis.

Currently trade reference prices for CRC (IS513) 0.9mm is hovering in the range of INR 46,500-47,000/MT (ex-Mumbai),INR 47,500-49,000/MT (ex-Delhi) and INR 50,500-51,000/MT (ex-Chennai). The prices mentioned above are basic prices excluding GST@18% on cash payment basis.

Thus major steel manufacturers mills have raised HRC & CRC prices in the month of March ‘19 in line with higher raw material cost and upsurge in global steel prices.

On other hand, few traders commented that,”Indian steel mills have raised HRC offers in domestic market but due to poor sales volumes, buyers are unable to accept the current price hike.Thus expecting discounts and rebates to push buying”.

Previously in the month of Feb’19 Indian steelmakers increased HRC & CRC prices twice in the month by INR 1,750-2,000/MT over improved demand and higher raw material cost.

Decline in Auto segment sales in Feb’19-As per market reports,in Feb'19 sales in auto sector witnessed decline due to subdued consumer demand,tight liquidity,higher interest rate and slowdown of industrial output.Market leader Maruti reported 3.3% decline in passenger vehicle sales and Tata Motors registered 9% drop in commercial vehicle sales on yearly basis in Feb'19.

Meanwhile general elections scheduled in April-May may also lead to further decline in sales volumes in upcoming month.

Thus increase in steel prices is difficult to absorb in domestic market over sluggish buying.

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Trump tariff surprise triggers implosion of massive copper trade

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Southern Copper eyes $10.2B Mexico investment pending talks

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Maxus expands land holdings at Quarry antimony project in British Columbia

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge

Gold price rebounds nearly 2% on US payrolls data

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge