Iran Domestic Billet Offers Up by USD 15/MT W-o-W

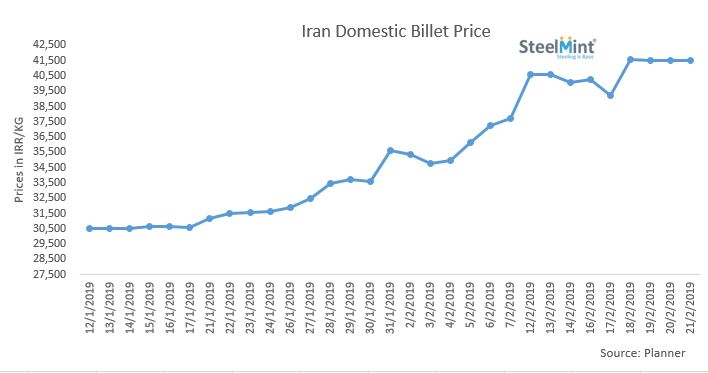

Iranian domestic billet offers has risen sharply last week by USD 15-18/MT W-o-W mainly because of increase in demand from re-rolling industry and increase in exchange rate.

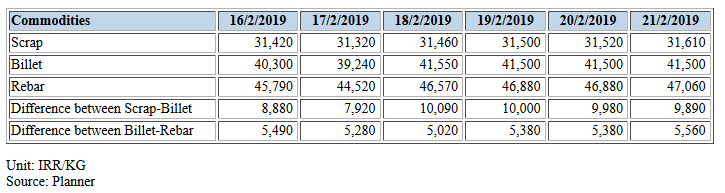

According to SteelMint assessment, during the beginning of week 8 (16-21 Feb’19) domestic billet offers were noted to be around IRR 40,300/KG (USD 468/MT). Offers went down on the next day to IRR 39,240/KG (USD 456/MT). Towards the mid of last week domestic offers of billet rose to IRR 41,550/MT (USD 482/MT) and remained stable till end of last week.

As per Planner, “Market is going up, partly due to seasonal demand and partly due to export by traders from domestic market. USD has been rising during the past 2 weeks. It is speculated that domestic offers would rise further after Nowrooz”.

IR Steel quoted, “Billet price has been upward due to continuous export of billet from Iran and increasing exchange rate. Some re rollers have to buy billet for producing long products which has pre sold it before.”

During last week, scrap offers in Iranian domestic market was noted to be around IRR 31,320 – 31,610/KG (USD 364-367/MT). Domestic rebar offers were ranged from IRR 44,520 - 47,060 /KG (USD 517-556/MT).

Major Steel Mills Offered Billet in IME

1 - South Kaveh Steel Company offered and sold 10,000 MT 5 SP bloom on 17 Feb’19 against the demand of 48,000 MT in IME at IRR 35,960/KG (USD 418/MT) excluding 9% VAT.

2 - South Kaveh Steel Company offered and sold 3000 MT 5 SP bloom on 17 Feb’19 against the demand of 14,500 MT in IME at IRR 35,770/KG (USD 415/MT) excluding 9% VAT.

3 - Khouzestan Steel Company offered and sold 30,000 MT 5 SP bloom on 18 Feb’19 against the demand of 119,000 MT in IME at IRR 38,516/KG (USD 447/MT) excluding 9% VAT.

4 - Arfa Iron and Steel Company offered and sold 7500 MT 5 SP bloom on 20 Feb’19 against the demand of 22,000 MT in IME at IRR 38,321/KG (USD 445/MT) excluding 9% VAT.

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Trump tariff surprise triggers implosion of massive copper trade

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Southern Copper eyes $10.2B Mexico investment pending talks

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Maxus expands land holdings at Quarry antimony project in British Columbia

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge

Gold price rebounds nearly 2% on US payrolls data

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge