U.S. Graphite Electrodes Major GrafTech Records Robust Sales and Profits in 2018

Sales volume up by 23% in Q4 FY18 and by 8% in FY18: GrafTech fourth quarter sales volume surged by 23% y-o-y basis from 43,000 tonnes in Q4 2017 to 53,000 tonnes in Q4 2018. The company’s annual sales registered an increase of 8% from 172,000 tonnes in 2017 to 185,000 tonnes in 2018.

Per tonne sales realisations up by more than 200% in FY18: In 2018, GrafTech’s average per tonne sales realisations stood at USD 9,937/MT against USD 2,945/MT in FY18. On a quarterly basis in Q4 FY18, the sales realisations stood at USD 9,950/MT against USD 4,137 tonnes in Q4 FY18.

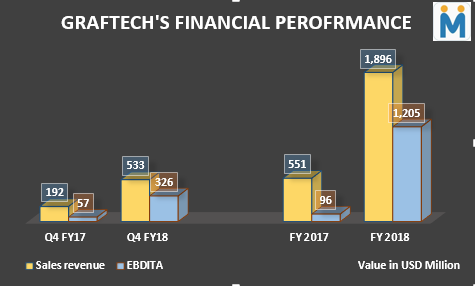

Net sales surge significantly amid increased realizations: With an increase in per tonne sales realisations coupled with rise in sales volumes, company’s net sales have also move up by more than 200% from USD 551 million in 2017 to USD 1,896 million in 2018. In Q4 FY18, GrafTech’s sales stood at USD 533 million against USD 192 million in Q4 FY17.

EBIDTA increased dramatically in 2018: GrafTech’s Earnings before Interest Depreciation and Tax (EBIDTA) for FY18 have been recorded at USD 1,205 million against USD 96 million in 2017. On a quarterly basis, the same has increased from USD 57 million in Q4 FY17 to USD 326 million in Q4 FY18. GrafTech reported a record Net Income of USD 854 million in 2018.

Other important information:

• In aggregate, GrafTech has added 40,000 MT of sales under long-term agreements for 2019-2023 at pricing above existing agreement.

• The company has completed its debottlenecking work at its plants (Spain, France, and Mexico) and the company’s production capacity as mentioned in previous quarter after debottlenecking has been increased by 35,000 tonnes to around 202,000 tonnes.

• 2019 will be the first year with increased capacity and the company will focus on operating debottlenecked plant whereas the potential restart of its idle St. Mary’s plant in U.S. (capacity of 28,000 tonnes) remains a long term option.

• GrafTech’s wholly-owned Seadrift subsidiary offers a secure, low-cost supply of needle coke and as mentioned by the company Seadrift production cost is well below third party needle coke price.

Column: EU’s pledge for $250 billion of US energy imports is delusional

Anglo American posts $1.9B loss, cuts dividend

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Southern Copper expects turmoil from US-China trade war to hit copper

Trump tariff surprise triggers implosion of massive copper trade

Eldorado to kick off $1B Skouries mine production in early 2026

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Newmont nets $100M payment related Akyem mine sale

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge

Gold price rebounds nearly 2% on US payrolls data

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge