Iran’s Aluminum Industry Looks Forward to Bright Future

The country can boast of considerable advantages when it comes to aluminum. It was one of the pioneers of aluminum industry in the Middle East.

Iran enjoys cheap energy resources and access to international waters for exports. As the lifting of sanctions imposed on Iran over its nuclear energy program, following the Jan. 16 implementation of nuclear deal struck between Iran and world powers, is expected to revitalize domestic industries, demand for aluminum will also increase.

Aluminum is one of the most widely consumed metals due to its low density and weight, corrosion resistance and environment-friendliness.

The metal is used in metallurgy, chemical, packaging, construction and energy industries, as well as in the manufacture of ships, cars, airplanes and trains. It is almost always alloyed, which markedly improves its mechanical properties, especially when tempered.

For example, the common aluminum foils and beverage cans are alloys of 92% to 99% aluminum. The main alloying agents are copper, zinc, magnesium, manganese and silicon, with the levels of other metals in a few percent by weight.

Bauxite, an aluminum ore, is the world’s primary source of aluminum. It is usually strip mined because it is almost always found near the surface of the terrain, with little or no overburden. As of 2010, between 70% and 80% of the world’s dry bauxite production is processed first into alumina and then into aluminum by electrolysis.

According to United States Geological Survey, global bauxite reserves are estimated to be around 75 billion tons, with Guinea, Australia, Brazil, Vietnam, Jamaica and Indonesia holding the world’s biggest reserves.

Iran, however, possesses close to 39 million tons of bauxite or less than 0.1% of the world’s total reserves, and its limited deposits are barely capable of providing enough raw material for the industry’s current 350,000 annual aluminum ingot output.

“Iran is weak in terms of bauxite reserves,” said Mehdi Karbasian, deputy minister of industries, mining and trade, emphasizing that bauxite and alumina procurement have always been one of the industry’s primary challenges.

The country’s only developed bauxite mine is the Jajrom Mine located in the city of Jajrom in North Khorasan Province, with reserves of less than 20 million tons.

Karbasian noted that mineral explorations undertaken during the previous two years have sparked glimmers of hope for finding new reserves, but long-term sustainability of the industry requires cooperation with global suppliers of bauxite and alumina.

The government made its first foray into a foreign country to exploit a bauxite mine 25 years ago but was held back for years due to lack of infrastructure and high transportation costs.

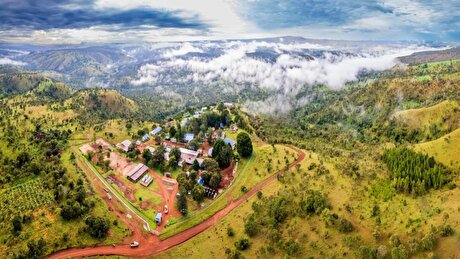

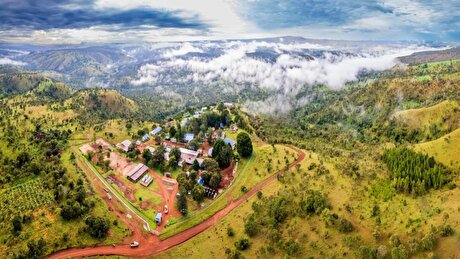

The effort to develop a bauxite mine in the West African nation of Guinea has not yet borne fruit. The 50-50 partnership with the Guinea government was recently renewed for another 25 years. The mine, possessing more than 500 million tons of bauxite, is located in Guinea’s Dabola City about 370 kilometers from the coast.

According to Bloomberg, Iran expects to issue a tender by the end of 2016 to build a pipeline in the African country to transport the bauxite mined to a port for shipment. The tender would be issued after an economic feasibility study is received from German consultants DMT GmBH in the next two to three months.

Nepheline Syenite: Alternative to Bauxite

It has been newly found that it is possible to replace bauxite with nepheline syenite beneficiation to produce alumina. Fortunately, reserves of about 1.2 billion tons of this mineral have been discovered in Sarab City of East Azarbaijan Province and investments have been made to extract this mineral.

This could be just what the industry needs, as using nepheline syenite for alumina production is about 20% cheaper than using bauxite and its byproducts can be used for producing cement and sodium, potassium and phosphate carbonates. This would also considerably reduce domestic reliance on alumina imports.

The government has put the Sarab nepheline syenite mine out to tender and is seeking foreign investors to undertake the project, according to the director of the project for producing alumina from Sarab’s nepheline syenite, Mohammad Jafar Ozmaei.

Cooperation With Foreign Firms

During the visit of President Hassan Rouhani and his accompanying high-ranking delegation to Italy in 2015, Danieli Group signed a deal worth $4 billion with the Iranian mines and Mining Industries Development and Renovation Organization for supplying Iranian aluminum companies with high-tech machinery and plants.

IMIDRO also signed an aluminum cooperation deal with the French Fives Group during the Iranian mission’s stay in Paris. The agreement entails the establishment of a joint anode production company through an engineering, procurement, construction and finance contract.

Anode, primarily made from petroleum coke, is one of the main raw materials required for aluminum ingot production and its manufacture usually accounts for nearly 30% of production costs.

The anode production plant, with a production capacity of 450,000 tons per year, requires close to $400 million and is IMIDRO’s largest initiative ever taken to expand Iran’s aluminum production capacity.

Furthermore, representatives of the Russian RUSAL aluminum company expressed readiness to cooperate with Iran in the production of alumina powder from nepheline syenite during a meeting with Karbasian back in late 2015.

RUSAL is the second largest producer of aluminum in the world after China’s Hongqiao Group.

Gold price to hit $3,600 this year and next: CIBC

Iran’s Copper Production Continues without Interruption

Aclara Resources, Stanford University partner on AI-powered rare earth research

Ultra-rare metal rides AI boom as commodities star performer

NexMetals receives EXIM letter for potential $150M loan

SolGold to start mining copper from Cascabel in early 2028

Energy Fuels shares surge to 52-week high as it begins heavy rare earth production

Antofagasta’s copper production up 11% in strong first half

Boliden mine to host world’s deepest marathon at 1,120m

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Gold price eases after Trump downplays clash with Fed chair Powell

Three workers rescued after 60 hours trapped in Canada mine

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

KoBold signs Congo deal to boost US mineral supply

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Gold price eases after Trump downplays clash with Fed chair Powell

Three workers rescued after 60 hours trapped in Canada mine

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

KoBold signs Congo deal to boost US mineral supply

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto