7 Things to Watch Out for in 2019

Iran: Sanctions to Eat into Exports?

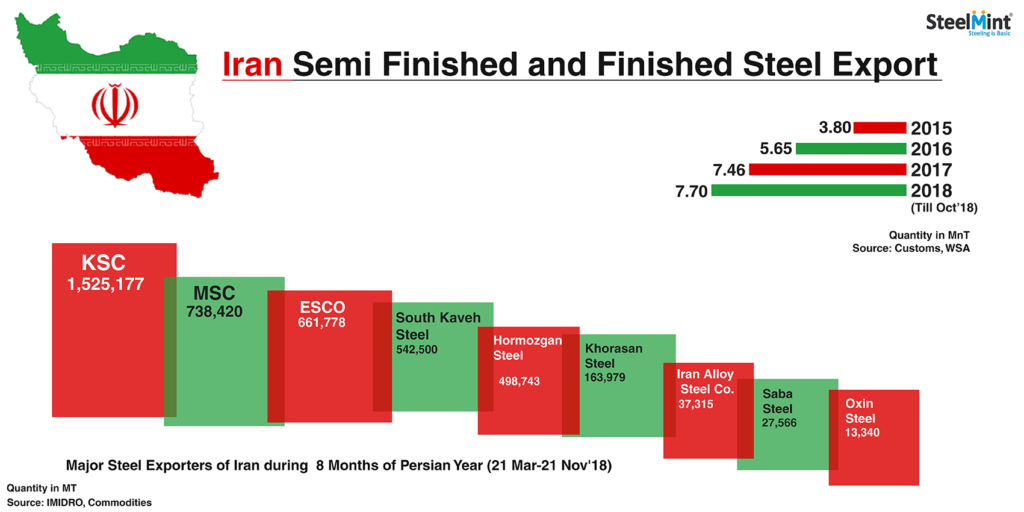

The impact of US economic sanctions on Iran is of particular interest to the global steel industry in 2019. Iran was slapped with economic sanctions in August last year and the second phase of sanctions kicked in on November 4 last. The impact of the sanctions on Iran’s hitherto burgeoning steel exports will be something to watch out for. Iran exported 7.46 MnT of semi-finished and finished steel products in 2017, as per data furnished by World Steel Association.

Within this total, exports of semi-finished steel products such as billet and slab accounted for 6.87 MnT. Now, although total steel exports inched up to 7.70 MnT in 2018, the rate of growth was far from inspiring. The adverse effects of the sanctions are already showing.

As SteelMint reported in the last week of December 2018, billet exports had declined by 14% in the first eight months of the current Persian year compared to the same period last year and prices remain weak. Likewise, slab exports recorded a sharp decline of 29% during the same period compared to last year.

India: Steel Exports to Inch Up

After a year of declining volumes, Indian steel exports could well go up in 2019. First, India could well find itself in the advantageous position of plugging the gaps left behind by falling exports from China. Given the fact that global steel prices are witnessing an upward correction at present, this could mean that the total value of Indian steel exports could increase.

Second, given the phenomenal capacity enhancement in the domestic steel sector there is a distinct possibility that capacity additions could reach a stage when supply would outstrip demand, thereby enlarging the export basket of the country. To take just a few instances, Jindal Steel & Power (JSPL) has completed commissioning of a BOF at its Angul plant in Odisha, the National Mineral Development Corporation (NMDC) is to start a 3 MnT greenfield facility in Chhattisgarh and the Steel Authority of India Limited (SAIL) is expanding steelmaking capacity at its Bhilai plant.

Also, since the Insolvency and Bankruptcy Code came into effect, 30 MnT of idle steel production capacity has been ripe for the picking. In May 2018, Tata Steel successfully submitted the winning bid for bankrupt rival Bhushan Steel in an auction. Likewise, acquisitions of Electrosteel, Usha Martin, Adhunik Metaliks and other plants could result in heightened production volumes with a significant chunk being earmarked for exports.

Samarco to Resume Pellet Production

After being forced to down shutters on operations for a period of three long years, Brazilian mining major Samarco has reached an agreement for resumption of operations.

The Samarco pellet plant, with an installed capacity of 30 MnT per year, was suspended due to the scary incident of dam failure in November 2015, resulting in loss of life and property.

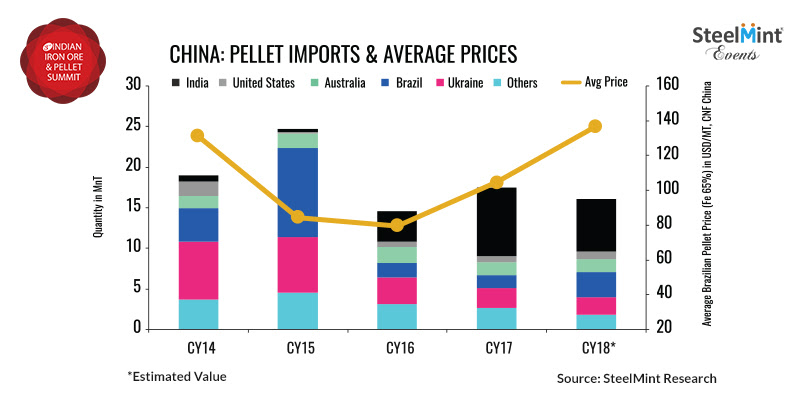

Both the companies have received the necessary licenses required to restart operations at Samarco; however, the plant will restart operations at a scaled down level of 8 MnT. The halt in operations post November’15 resulted in increased pellet export volumes from India.

The scarcity of the material in the global market resulted in increased opportunities for Indian pellet exporters. After The Samarco suspended operations, Chinese as well as non-Chinese mills shifted towards Indian pellets to fulfill the demand which resulted in significant growth in pellet exports from India post 2015.

However, with Samarco resuming operations, supply side concerns are expected to cease and global pellet prices, likewise, are expected to ease a bit. But, Indian exports could be hurt in the near and long term.

All Eyes on Indian Iron Ore Mining Auctions

To preempt crunch in supply of non-coal minerals when 288 merchant mining leases expire in April 2020, the government in 2018 amended the rules for mineral concession and development to pave the way for re-auctioning of these leases even before their expiry. Early start of the auction process for these mines, containing minerals such as iron ore, manganese ore, bauxite and limestone would ensure production is not disrupted for a long period.

Only 48 mines are operative now. As per the estimates of the ministry, 101 mines are eligible for auctions. In Odisha, 17 merchant iron ore leases are set to expire by March 2020. The ending validity of these mines is set to trigger deficit of 66 MnT of iron ore annually. If other states like Karnataka, Goa and Jharkhand are factored in, total loss in iron ore production capacity could be 85 MnT a year. Major mining leases in Odisha lapsing by March 31, 2020 include the ones held by Rungta Mines, KJS Ahluwalia, Serajuddin & Co, Kaypee Enterprises and Kalinga Mining Corporation. The Odisha Mines Department is preparing the ground to auction 31 working mines, mostly iron ore and manganese leases, which are due to lapse by March 31, 2020.

China About To Go Into Reverse?

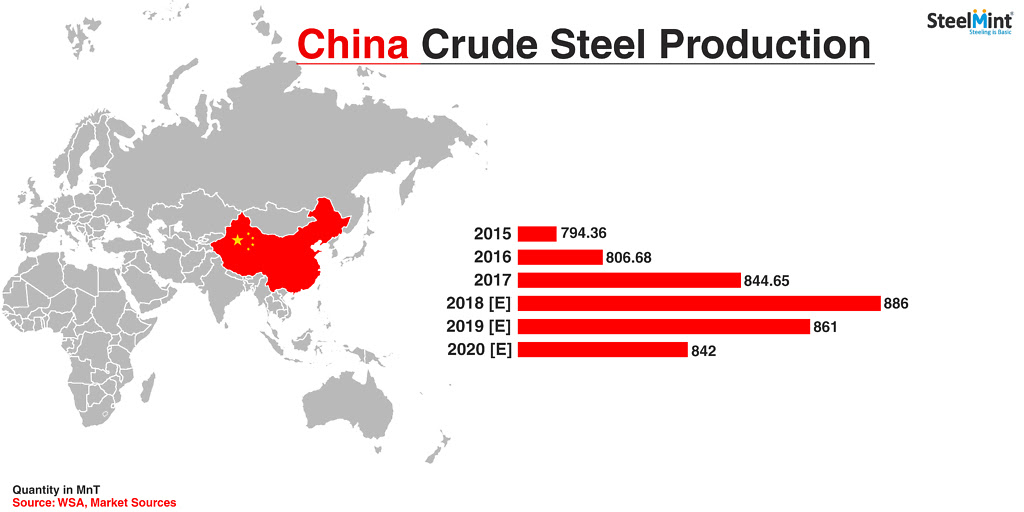

Forecasts are that the world’s largest steel market is about to go into reverse. Production in China will peak in 2018 and then shrink next year as local demand drops, according to forecasts by leading market intelligence firms. Mainland steel production, after topping out at 886 MnT, is expected to drop to 861 MnT in 2019 and hit 842 MnT in 2020, an Australian government report predicts.

Over the same time frame, Chinese domestic demand is seen contracting by 34 MnT. China accounts for half the world’s steel output, and trends in its mammoth industry shape the worldwide market. The expected drop-off in mainland production is driven by a suite of government policies, including stricter environmental regulations, supply-side reforms reducing some loss-making capacity, and a push to cut debt.

According to the World Steel Association, China’s persistent rebalancing efforts and ever-toughening environmental regulations will eventually lead to deceleration in steel demand in 2019. However, the WSA forecasts that despite the trade friction with the USA, if the Chinese government’s stimulus measures in generating domestic demand for steel by major investments in the property market and road-building initiatives bear fruit, then domestic demand in China will receive a much-needed boost. Experts, though, are unsure whether these stimulus measures will yield the desired results. It is noteworthy that Moody’s Investor Services, too, has predicted Chinese demand to remain flat in 2019.

Scrap Imports to Bangladesh Could Spiral

Bangladesh is emerging as the next steel hotspot in South Asia, with over 2 MnT of steelmaking capacity being added in the country in the course of the past two years, thereby significantly driving imports of steel scrap, pig iron and DRI.

With the reinstatement of a stable government, it is expected that demand will pick up and business will gain the much-desired momentum. The upsurge in demand is mostly attributable to the government’s spending in infrastructural projects, which constitutes about 40% of steel consumption in Bangladesh.

GPH Ispat is expected to start production from its 0.8 MnT EAF, BSRM is likely to add 0.5 MnT additional capacity and another 0.5-0.6 MnT additional capacity is expected to get commissioned in 2019.

Vietnam on Capacity Enhancement Spree

Vietnam is one of the largest steel importing countries in the world with an annual volume of 14 MnT.

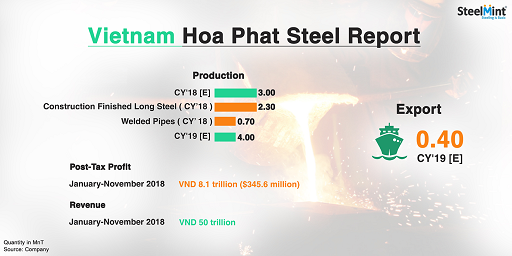

With local steel mills increasing capacities at an alarming pace, imports are likely to drop in 2019. Hoa phat has announced that they will increase their production by 33% to 3.5-4 million tonnes in 2019. Formosa is likely to increase its production to 7 million tonnes in 2019 from current production of around 4-5 million tonnes.

According to data maintained by SteelMint, Vietnam’s crude steel production has increased by over 60% in 2018 from 8.94 MnT to 14.4 MnT.

2019 will be a difficult period of countries relying on steel exports to Vietnam, of which China and India holds major share.

On the other hand, raw material imports to Vietnam will increase in 2019.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook