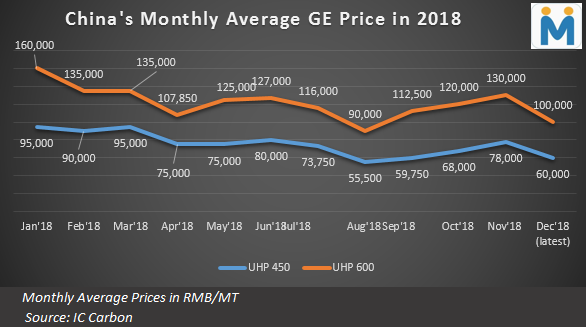

Why China’s Graphite Electrodes Prices are Falling?

With the start of December month, the domestic GE prices in China have plunged significantly and the decline in the GE of 600mm UHP grade specifications was the highest, around RMB 15,000-20,000/MT (USD 2,175 – 2,900/MT). In case of UHP 450mm GE, the prices have plunged from RMB 68,000/MT (USD 9,860/MT) in November end to around RMB 55,000/MT (USD 7,970/MT) at present, a decline of around 20% in the time span of just ten days.

The key reasons for the downtrend in GE prices

According to few market participants in China, some of the GE manufacturers in the country have purposefully lowered their electrodes prices in December, in order to complete their annual sales target, following which others also have followed the suit in competition. A similar trend was observed during July and August month this year when there was a wave of irrational decline in Chinese GE prices due to the sales strategy of the electrodes manufacturers.

Along with this, the fall in China’s GE prices can be attributed to production restrictions during winter heating season that has started from the month of November.

Last year during the heating season, the Chinese government had announced production cuts for both steel companies and GE producers as the measure to control pollution. This year, although the production restrictions have been announced, the GE manufacturers have equipped themselves with environmental protection equipment, resulting which the production cuts by the GE manufacturers is relatively smaller against the GE output cuts in 2017.

This comparatively higher supply of GE during ongoing winter heating season is combined with relatively slow GE demand from EAF producers (due to production restrictions) and falling steel prices resulting which there is demand-supply mismatch, impacting electrodes prices negatively.

For coming next few weeks, the market environment seems to be weakened and the substantial improvement in market fundamentals seems unlikely. Profits of steel plants are also low and their production willingness is dampened. In addition to this, the end demand is also in the seasonal lull.

With both supply and demand appearing sluggish, steel market is expected to maintain low and sideways movement in the bottoming process. With tepid steel demand, the GE prices are also unlikely to take an upward trend. However, chances are high that the situation may change before the start of Chinese New Year holidays in the month of Feb’19.

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Trump tariff surprise triggers implosion of massive copper trade

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Southern Copper eyes $10.2B Mexico investment pending talks

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Maxus expands land holdings at Quarry antimony project in British Columbia

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge

Gold price rebounds nearly 2% on US payrolls data

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge