India: Nepal's Buying Interest Remains Bearish for Billet & Wire Rod

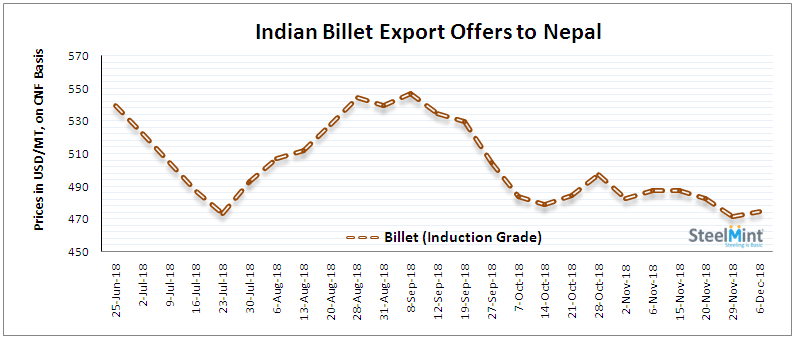

The latest export offers for induction grade billets (100*100 mm) from eastern India, Durgapur hovering at USD 445-450/MT ex-mill, equivalent to USD 470-475/MT CFR Raxaul border(Nepal) & USD 445/MT loaded to rake, Odisha, this will equivalent to USD 470/MT CFR Raxaul border (Nepal). The offers increased by USD 3-5/MT (W-o-W) on surge in Indian domestic prices and strong rupee against US dollar.

As per exporters, in last couple of days small lots of Billet have been sold out at close to USD 440-445/MT ex-mill at Durgapur.

Meanwhile mute demand is being reported for Wire rod which offers are currently evaluated at USD 540-545/MT ex-mill, Durgapur. On CFR Nepal basis it would cost about USD 570/MT CFR Raxaul border, Nepal.

Rebar Prices Slump by NPR 7,000/MT (USD 62 or INR 4,400) M-o-M

The domestic rebar prices significant on fall as per mills in Birgunj, Nepal. As per them fund crisis rise in the nation, this led to poor off take in finished products led to surge in stock and made panic trends.

Post Diwali festival, there is peak season in Nepal for the construction activities, which boosts demand for steel, however in current year coincidentaly it weakened, he added.

The local rebar prices for commercial grade by small mills reported at around NPR 72,000-73,000/MT (INR 45,300-45,900/MT or USD 638-647/MT), fall from a week ago at NPR 74,000-75,000/MT (INR 46,500-47,150/MT or USD 656-665/MT) & a month ago at NPR 78,000-80,000/MT (INR 49,050-50,300/MT or USD 691-709/MT). The prices are ex-works, 12mm & excluding local taxes.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts