Vallourec expects inventories to weigh on 4Q demand

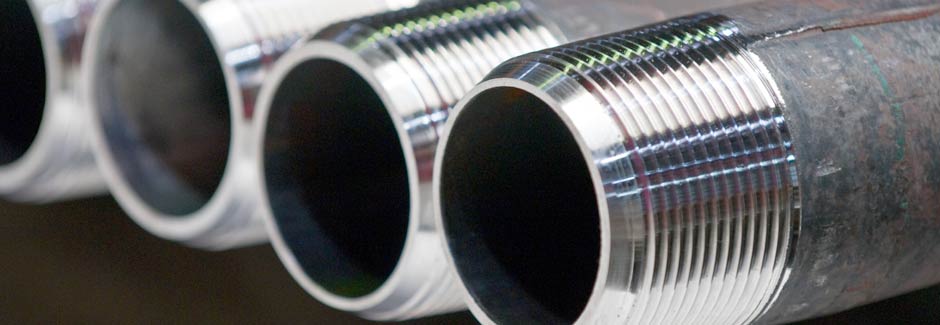

Tubular consumers accumulated strong inventories of oil country tubular goods (OCTG) in advance of the implementation of the US 25pc tariff on foreign steel in March and will look to drawdown these positions to minimize year-end inventories, the company said in its third-quarter earnings release.

Consumer inventories are hard to quantify, but "we feel it, and this is resulting in lesser demand from customers as of today" compared with the third quarter, Vallourec chairman Philippe Crouzet said. Fourth-quarter shipments are also expected to be down from the year-earlier quarter.

Still, Vallourec expects the impact of the inventory build-up to be short-lived as higher levels of drilling activity in the US sustain demand.

Active oil and gas drilling rigs rose to 1,082 this week from 915 at the same time a year earlier, according to Baker Hughes data. The rig count has remained above 1,000 since topping that level in April for the first time since 2015.

Stronger drilling activity comes as the US tariff helps limit OCTG imports, supporting higher selling prices for domestic producers.

"For the fourth quarter we see [prices] about flat from the third quarter, in line with the market catching its breath," North American senior vice president Nicolas de Coignac said.

The company did not provide its selling prices, but said they were "significantly" higher in the third quarter from the prior year. Revenue per tonne shipped climbed to €1,648/t ($1,881/t) from €1,639/t a year earlier.

US imports of oil country goods and other pipe and tube products fell by 10pc to around 5.1mn t through September from the same period a year earlier. Overall steel imports fell by 12pc to 22.9mn t.

Vallourec also said it expects drilling activity in Brazil to be stable in coming months, while its oil and gas operations in its Europe, Africa, the Middle East and Asia division (EA-MEA) are expected to benefit from stronger shipment volumes at higher prices.

The steelmaker shipped 583,000t globally in the third quarter compared with shipments of 588,000t in the same period of the prior year.

Shipment activity benefited from "good momentum" in the US amid strong drilling activity and reduced import levels, while destocking among European steel distributors slowed volumes in the region.

Third-quarter revenue across the group ticked down to €961mn ($1.1bn) from €964mn as higher revenue from the oil, gas and petrochemicals markets, driven by higher OCTG prices in the US, was offset by a sharp drop in sales to the power generation market resulting from fewer projects in Asia.

The negative impact of converting foreign currencies into Euros from sales in Brazil and the US also weighed on revenue.

Earnings before interest, taxes, depreciation and amortization (Ebitda) jumped to €43mn from €9mn as higher OCTG prices boosted margins. But costs related to the closing of Vallourec's Belo Horizonte, Brazil, blast furnace and steel production facilities drove a loss of €92mn from €119mn in the prior year.

The company swung to positive earnings of €61mn on revenue of €2.8bn through the first nine months of 2018 from negative Ebitda of €9mn on sales of €2.7bn in the same period a year earlier. The overall loss widened to €399mn from €373mn even as shipments ticked up to 1.7mn t from 1.6mn t.

Vallourec operates pipe mills and finishing units in the US in Ohio, Oklahoma and Texas, in addition to plants in Europe, Africa, the Middle East and Asia.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook