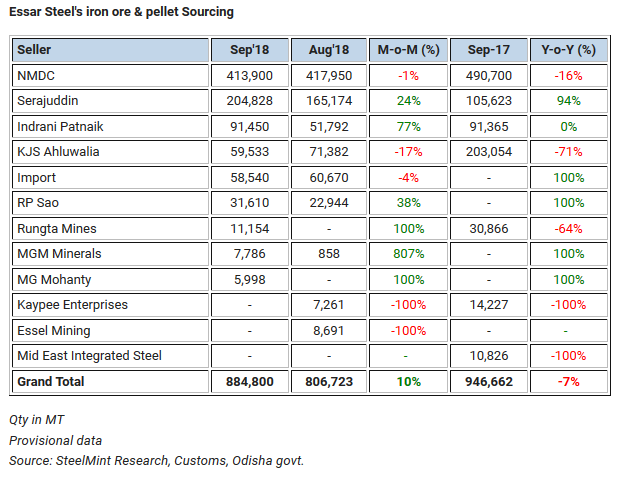

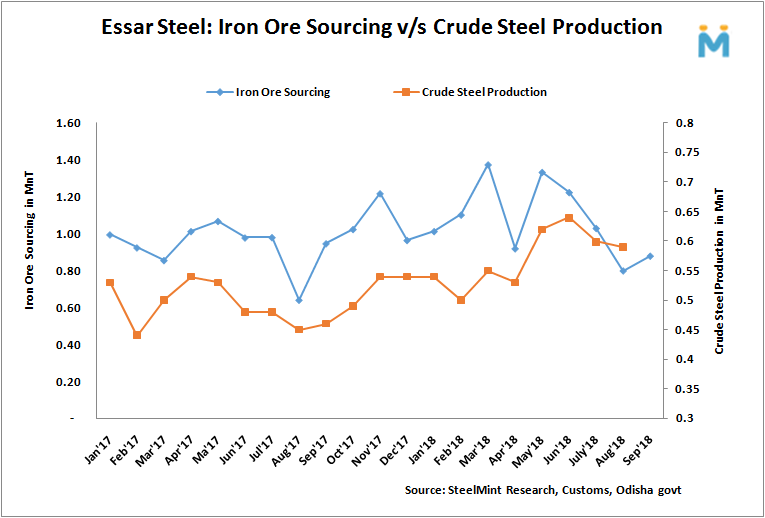

Essar Steel: Iron Ore Sourcing Up 10% in Sept'18

However, on yearly basis iron ore & pellet sourcing witnessed fall of 7% in Sep'18 as against 0.95 MnT in Sep'17.

Iron ore procurement from NMDC (C.G.) down slightly on monthly basis

Essar Steel procured 0.41 MnT of iron ore in Sep'18 from NMDC's Bailadila mines in Chhattisgarh via slurry pipeline, down slightly against procurement in Aug'18 at 0.42 MnT.

On 26th Sept 2018, the miner had increased Baila fines prices by INR 200/MT, Baila lump by INR 300/MT, ROM by INR 280/MT and DR-CLO by INR 360/MT. Prior to this on 7th Sept the miner had raised prices by INR 150-370/MT.

On yearly basis, the steelmaker depicted 16% decrease in Sep'18 sourcing as compared to 0.49 MnT in Sep'17.

Sourcing from Odisha merchant mines up 26% M-o-M

Essar Steel sourced 0.41 MnT iron ore in Sep'18 from Odisha's merchant mines, up 26% as compared to 0.33 MnT a month before.

SteelMint has learned from the sources, that those merchant miners were heard offering discounts over increased offers to stimulate buying interest.

Out of the total iron ore sourced from Odisha in Sep'18, largest share was contributed by Serajuddin at 0.20 MnT (up 24% M-o-M) followed by Indrani Patnaik at 0.09 MnT (up 77% on monthly basis) and KJS Ahluwalia at 0.06 MnT (down 17% M-o-M)

Essar Steel imports dip marginally on monthly basis

Essar Steel's iron ore and pellet imports witnessed at 0.058 MnT in Sep, down 4% on monthly basis.

All the imports from Bahrain observed for the month were pellets.

Essar Steel lenders choose Arcelor Mittal as Highest Bidder

According to the latest update in Essar Steel's long-standing bankruptcy case, company's Committee of Creditors (CoC) has chosen Arcelor Mittal (AM) as the preferred bidder for the insolvent asset ahead of its key competitor Numetal and other contender Vedanta Group. However, the final bid price will be negotiated over the weeks to come.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook