Gold price set for worst January in 10 years

Investor sentiment reversed later in the session as bullion recovered from earlier losses. Spot gold was up 0.5% to $1,853.65 an ounce by 11:40 a.m. EST, while US gold futures gained 0.3% and traded at $1,851.10 an ounce.

Nevertheless, the precious metal has lost about 2.8% so far this month, on course for its worst January performance since 2011.

“If I look at gold, it seems the market was looking for a more dovish Fed,” Giovanni Staunovo, an analyst at UBS Group AG, told Bloomberg. “I still believe we will see a higher price this quarter, supported by low(er) US real rates and a weaker US dollar.”

Weak demand

Bullion’s slow start to the year may be explained by weaker demand for gold during the past quarter.

According to the World Gold Council’s latest Gold Demand Trends report, gold demand fell 28% year-on-year to 783.4t (excluding over-the-counter activity) in Q4 2020, making it the weakest quarter since the midst of the Global Financial Crisis in Q2 2008.

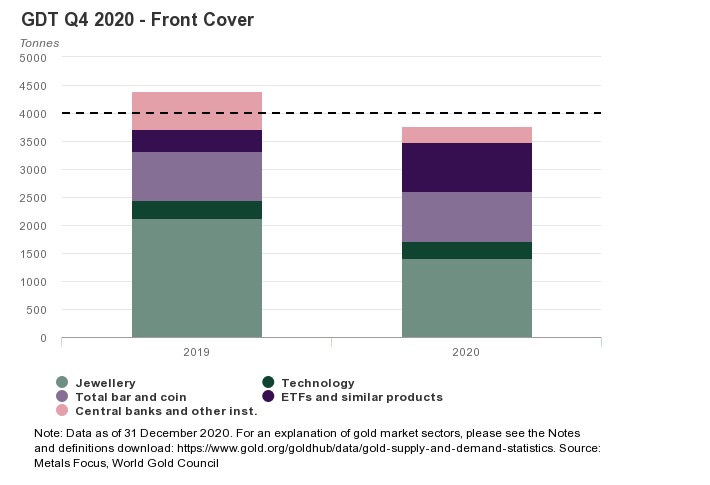

The coronavirus pandemic, with its far-reaching effects, was the driving factor behind weakness in consumer demand throughout 2020, culminating in a 14% decline in annual demand to 3,759.6t, the first sub-4,000t year since 2009.

Gold jewellery demand in Q4 declined 13% year-on-year to 515.9t, resulting in a full-year total of 1,411.6t, 34% lower than in 2019. This also marks a new yearly low for the Council’s data series. While demand improved steadily from the severely depleted Q2 total, the coronavirus continued to have an impact on consumer behaviour.

Despite 130t of outflows in Q4, gold-backed ETFs still saw record annual inflows as global holdings grew by 877.1t in 2020. In addition, evidence suggest that OTC activity, which is not directly captured in the WGC dataset, was also robust throughout the year.

Total gold supply of 4,633t was 4% lower year-on-year, the largest annual fall since 2013. The drop can be largely explained by covid-related disruptions to mine production, offset by a marginal 1% increase in recycling to 1,297.4t for 2020.

While 2021 will likely continue to be characterized by uncertainty, owing to the covid-19 pandemic, gold investment will remain well supported by the interest rate environment, the Council added.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts