Chinese Mills Raise Bids for Low Grade Indian Iron Ore Fines

However, deals haven't reported at high bids so far. Last deals reported for Fe 57% fines from Odisha were at USD 50-52/MT, FoB India levels.

Why has low grade iron ore prices picked up?

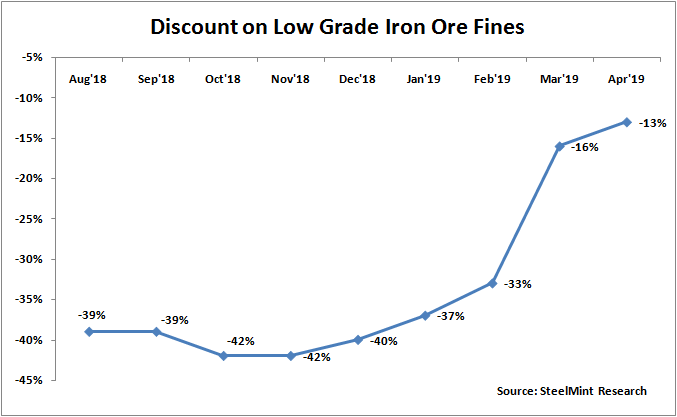

1.Hike in global iron ore (Fe 62%) prices: The global iron ore fines prices (Fe 62%)has increased to USD 95.8/MT CFR China, the prices have hit 5 years high. Sharp rise in high grade iron ore prices have led Chinese mills to hunt for low grade iron ore.. The month of April is marked by highest construction activities in China and also relaxation in production curbs in the country has led to increased preference for lower grade ore in China.

2.Supply disruption indications: The January collapse of mine dam waste in Brazil operational at Vale followed by cyclone in Australia has led to drop in global availability of material. As a result, global iron ore miners have slashed their 2019 estimates leading to material availability crises.

3.Shutting down of domestic mines in China: As per reports received to SteelMint, China's Hebei province this year will shut down 40 mines (other than coal mines) and 51 tailings dams. On March 29, the non-coal mine working conference was held in Shi Jiazhuang, the provincial capital of Hebei province.

High demand for low grade ore from China has turned Indian iron ore exporters active. Many merchant traders and big miners like Rungta and Essel have increased their shipments to east coast. Also, traders like SM Niryat, Bagadiya Brothers, Kashvi Power are booking decent quantities. However logistics remains a constraint for material movement.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook