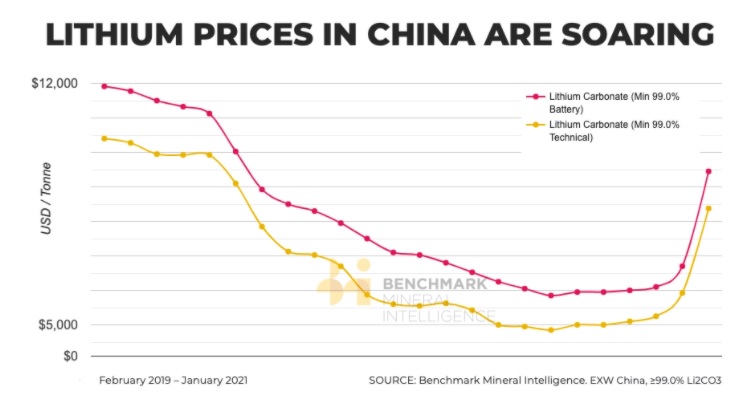

Lithium price in China surges 40% to 18-month high

Benchmark’s battery grade lithium carbonate midpoint price (EXW China, ≥99.0% Li2CO3) in January surged by over 40% compared to the same month last year to 61,000 yuan per tonne (~$9,450 a tonne), the highest level since June 2019. Price came close to $25,000 a tonne at the start of 2018 but has been in steady decline since then.

Benchmark lithium analyst George Miller said the “lithium ion battery related policy incentives in China are geared towards subsidising shorter-range vehicles, public transport fleet electrification, 5G power stations, all of which encourage LFP consumption”:

“It’s back to the future for lithium in China.

“Demand for durable, improved, and low cost LFP cathode material has become rejuvenated in China – a very similar story to what we saw in lithium’s last price run of 2016 but with a much improved product for the 2020s.

“Although this surging price trend has largely been confined to lithium carbonate within China, this has had a knock-on effect elsewhere, drawing up lithium carbonate prices out of South America by 10%, and 6% for spodumene feedstock in Australia.”

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Trump tariff surprise triggers implosion of massive copper trade

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Southern Copper eyes $10.2B Mexico investment pending talks

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

First Quantum scores $1B streaming deal with Royal Gold

Maxus expands land holdings at Quarry antimony project in British Columbia

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine